Nicholas Kosar

Wells + Associates (W+A) performed a Property Mobility Audit for Beacon Capital Partners’ Chicago properties in November 2020, during the height of the COVID-19 pandemic, which emptied out offices and public transit systems across the country.

The majority of Beacon’s tenants commuted on public transit to their Chicago properties pre-pandemic, but abruptly switched to working from home when the pandemic hit. Despite Beacon’s many on-site mitigation efforts, very few returned to the office for months on end. Beacon decided to investigate in order to prevent any negative leasing impacts.

The Audit identified existing on-site transportation amenities through a property manager questionnaire and gathered information about tenants’ employee commutes through a commute survey. W+A also used GIS and traffic data to verify and evaluate the commuting options at each property. Using the property manager questionnaire and the commute survey, W+A was able to recommend a suite of TDM strategies most likely to improve the tenant transportation experience at each of Beacon Properties’ Chicago properties, through a combination of on-site amenities, transportation services, TDM programming, and incentives programs.

The Hyper Local Nature of Transportation Service

All six of Beacon’s Chicago properties are located in what would be considered “downtown” Chicago. However, on a closer look, their locations on particular city blocks do strongly impact the tenant experience.

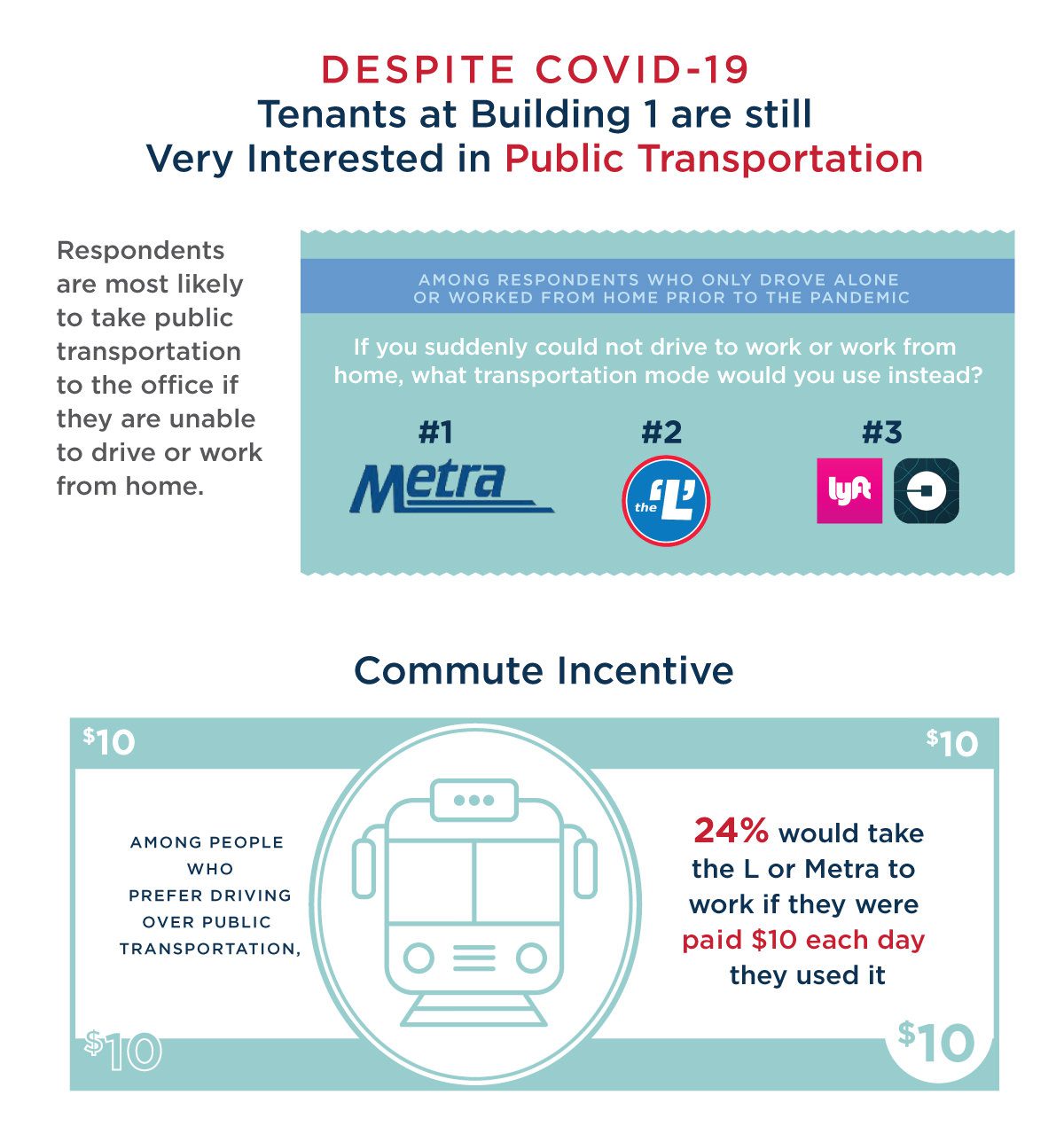

When it comes to commuting, the distance on foot that tenants must walk from a transit hub or parking location has a big impact on what is convenient for them. Each of Beacon’s properties are uniquely situated to certain L trains, which extend in different directions, or to the Metra commuter rail, while some are only walkable to bus stops. Given the degree to which these buildings relied on public transit accessibility—tenants responded that they used the L and Metra trains at extremely high rates prior to the pandemic—it was critical to identify how buildings could reestablish these transit connections or overcome ongoing disruptions and get tenants back into their offices.

1. Property Questionnaire: Existing Amenities

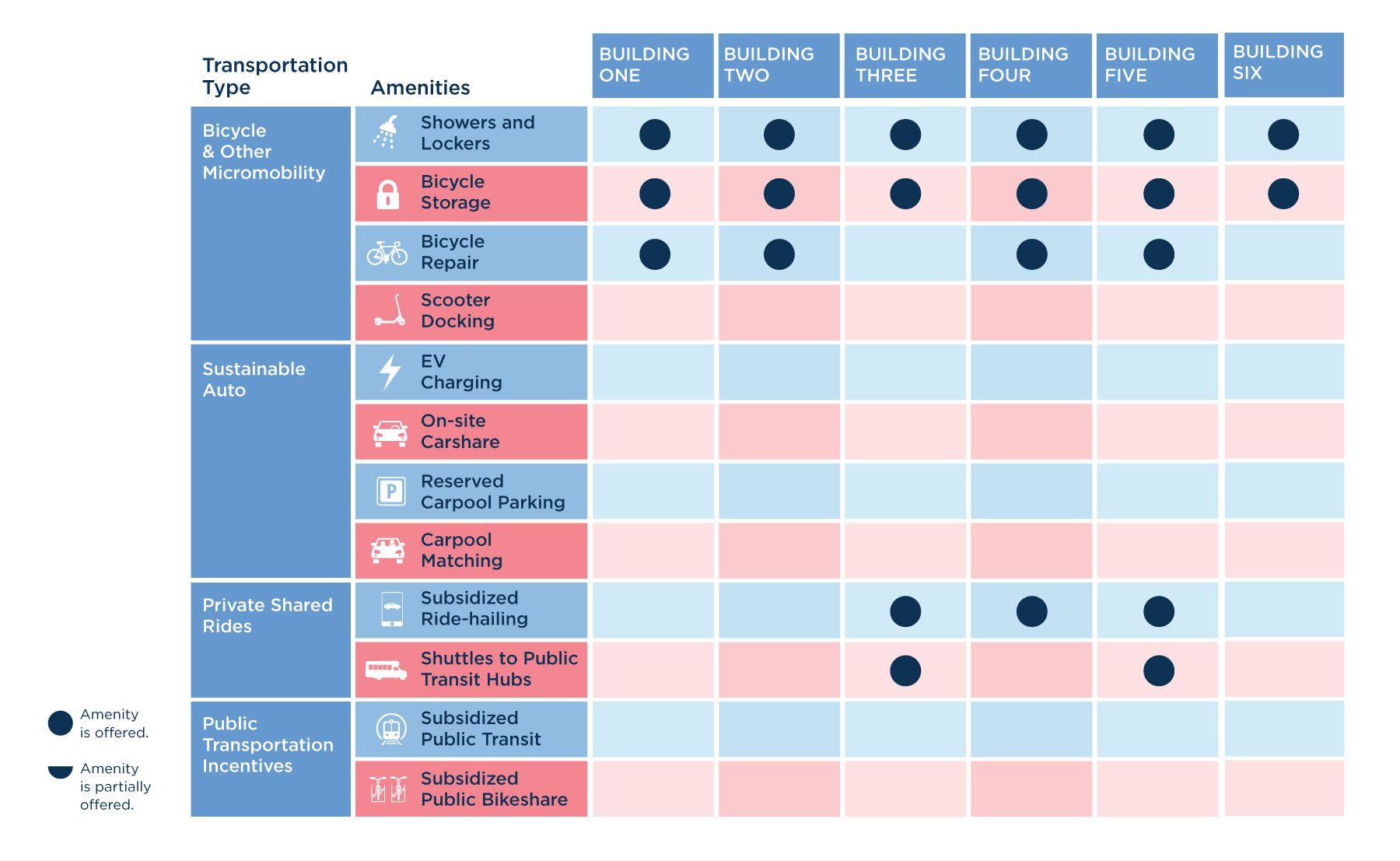

In addition to their physical orientations to city-wide transportation services, buildings can increase the uptake of certain modes of transportation by providing on-site services or amenities. W+A’s first step was to establish a list of “best practices,” based on properties across the country that set high standards for transportation amenities, and simply ask property managers at each of Beacon’s Chicago properties whether any of these amenities were available on-site.

By auditing existing transportation amenities at Beacon’s Chicago properties—using industry standards—W+A was then able to perform a type of “gap analysis” for the portfolio which identified amenities that were missing. This first round of analysis basically compared Beacon properties against themselves and highlighted which properties were not meeting Beacons’ own standards. For instance, all but one property provided bike repair, and the majority of properties over a half mile walk from transit hubs had last-mile support, such as subsidized ride-hailing or scooter docking capabilities. W+A then recommended that these outliers provide these missing amenities. In this review, W+A also identified some strategic advantages that could be better leveraged: for instance, only two properties had on-site parking. W+A recommended these buildings better leverage these garages by adding both carpool matching and free carpool parking to their amenities package, especially given an anticipated increase in demand for parking whenever tenants returned to the office.

2. Employee Commute Survey: Tenant Commuting Patterns by Building

Reviewing the amenities offered at all Beacon properties in Chicago set a baseline of what on-site amenities Beacon should provide; W+A then used survey results to understand the unique commuting patterns at each building.

To understand both structural and subjective reasons for workers’ avoidance of downtown office buildings, W+A performed a comprehensive survey designed to both predict and support behavior change among its tenants. The survey covered pre-pandemic habits and preferences, current habits and preferences during the pandemic, and tenants’ commuting plans for the near future, when much of the public expected the rollout of vaccines. This survey simultaneously measured commuting barriers under “normal” circumstances and sought to compare them to the pandemic-specific commuting barriers that characterized much of 2020 and 2021.

The commute survey helped W+A understand which transportation amenities and programming would most likely be used and adopted by tenants of a building. For instance, it revealed that users at one building lived primarily south of the city and commuted via the commuter rail train. These patterns could be due to self-selection, for instance, if the commute was a significant factor for choosing their current role. It could also reflect that workers moved to neighborhoods most accessible to their office after taking the job. Similarly, biking was very strong at a building which was not proximate to public transit but was accessible by bike to northern neighborhoods.

Findings: The New Normal is Working from Home or a Hybrid Schedule

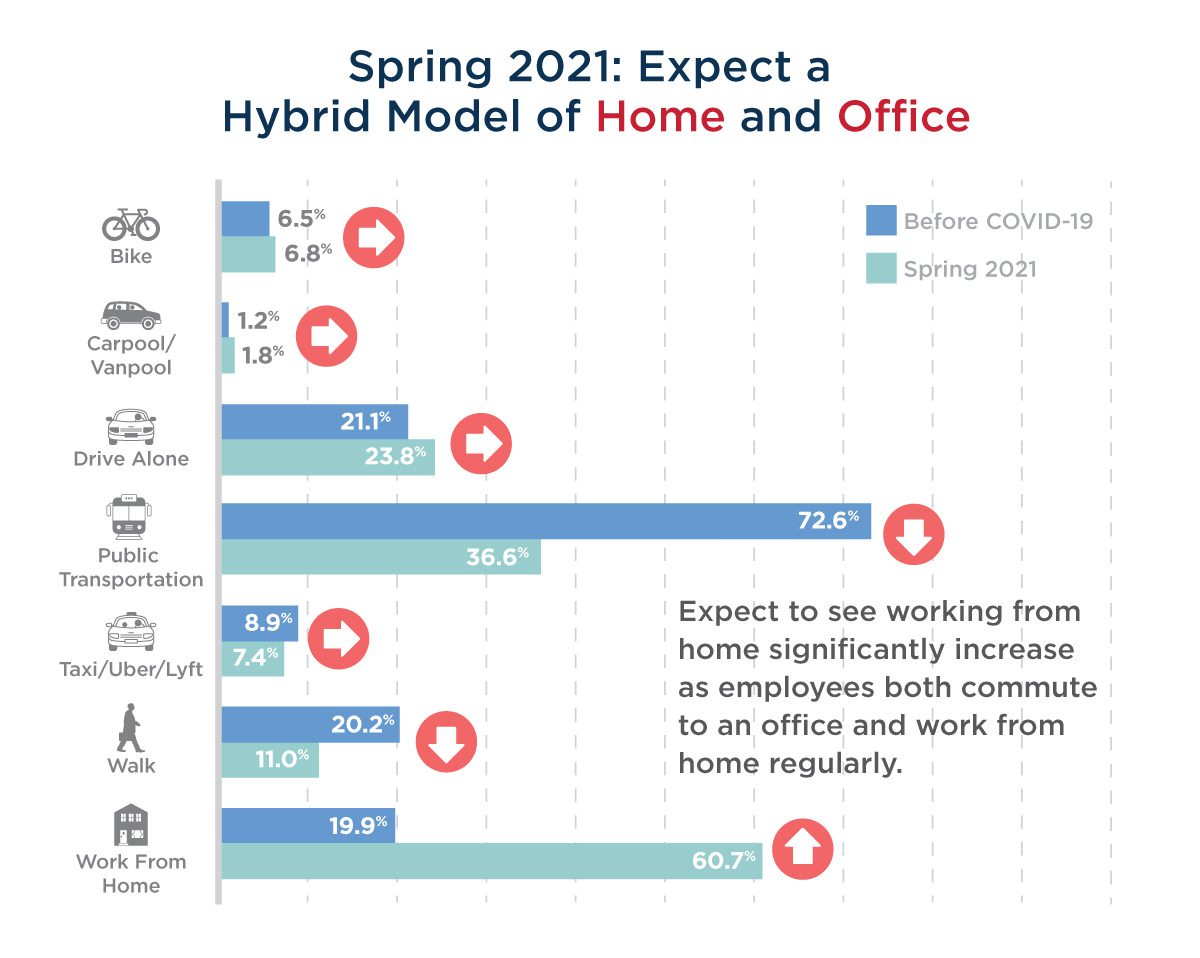

These commute patterns revealed what tenants find convenient as well as what they are used to, setting a baseline what commute behavior tenants find realistic. However, several questions on the survey were designed to understand tenants’ more subjective views on their commute and identify what type of commute they would like to have in the near future (measured as 6 months in the future, when hopefully the pandemic would be improving).

A central finding was that working from home was the preferred choice when tenants faced any challenge regarding commuting to the office. Tenants who said they would return to the office when the pandemic improved still indicated they would only come in 2-3 days a week. Therefore, W+A found that working from home was the main competition faced by all commute modes, a significant shift away from the top preference being driving alone to an office.

Recommendations: How to Get Tenant Employees Back in Buildings

Some buildings had maintained high work-from-home rates prior to the pandemic, while others were trying it for the first time. W+A classified tenants at buildings with high rates of working from home pre-pandemic to be “high-risk” of not returning to the office in force, and those with high rates of working at the office to be at lower risk for that outcome.

For buildings with many people who might not return, W+A recommended more strategies than the on-site infrastructure or their downtown location necessarily dictated. These buildings needed to go above and beyond and provide every incentive possible to make coming back to the office as frictionless and appealing as possible, so it would be chosen over working from home. Buildings that were considered lower risk appeared to have a tenant population that was more eager to return to their earlier patterns of commuting. In these cases, W+A highlighted amenities and programming that were primarily aimed at encouraging tenants to pick back up where they left off and return to their prior commute modes.

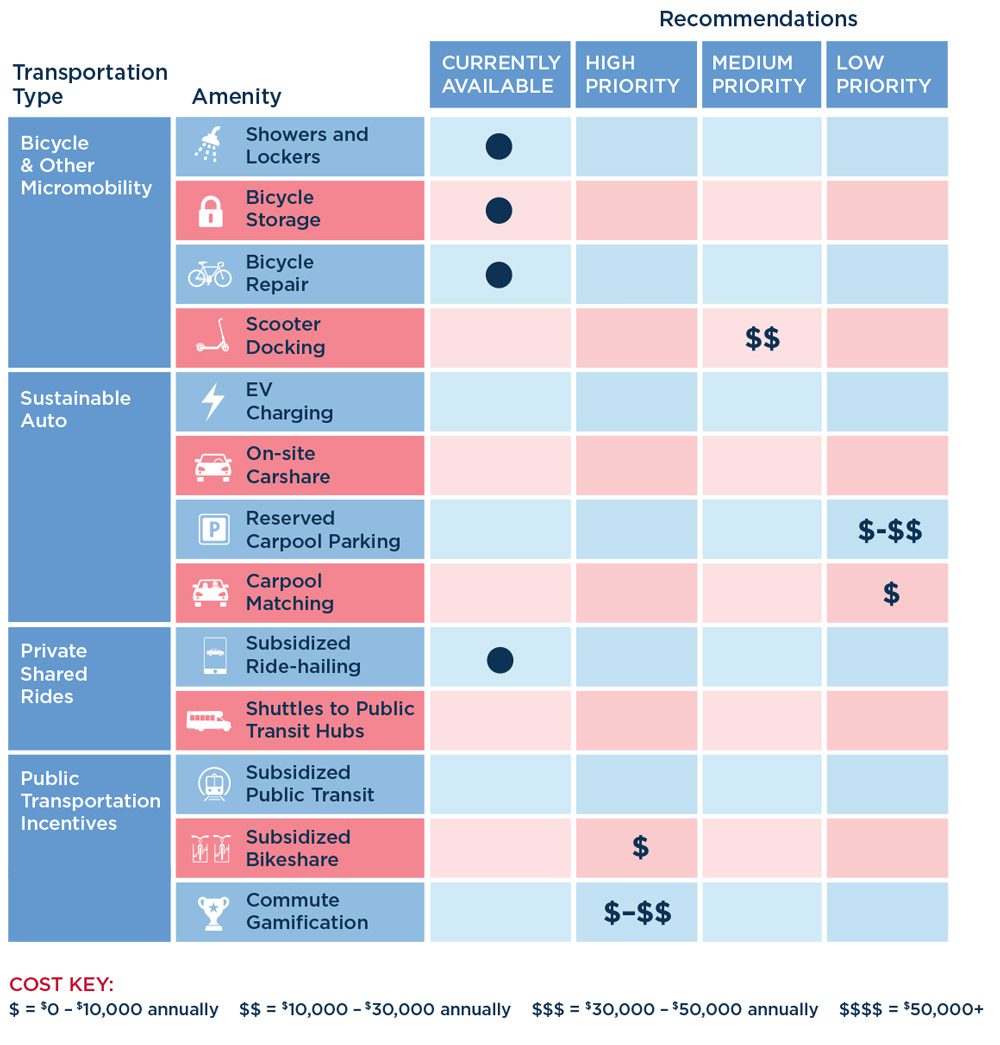

Where To Start? Prioritization and ROI

To provide Beacon Properties with a sense of which strategies to prioritize, W+A listed each strategy by priority level as well as a general cost range. Using all it had learned about the buildings, including their current amenities, pre-pandemic commute patterns, and tenant preferences, W+A recommended strategies that were identified as “missing” from the buildings and strategies that were in line with tenants’ preferences, chiefly the interest in working from home or on a hybrid schedule. W+A listed each strategy by priority level as well as general cost range, which enabled Beacon Properties to hone in on strategies that would provide the strongest return on investment.